西郊云庐售楼处电话:400-891-9910

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

看房请提前致电预约,可享受内部渠道优惠!联系销售人员获取最新一房一价表,官方售楼处最新优惠底价!开发商官方销售人员将详细介绍每个户型的独特设计和优势,带您参观样板间,感受精装修的品质和温馨氛围。您还可以了解周边配套设施,包括高端购物中心、优质学校和便捷交通网络,让您的居住体验更加完美。

长宁区程家桥街道

「西郊云庐」即将入市!

推出建面约101-220㎡2-4房

联动价约11.8万/㎡!

售楼处线上火热预约中!

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

作为上海的老牌中心城区,长宁区近年来无论是新房端还是土地端的供应,几乎都是全市垫底!

2024年之前的十年,长宁一共只在公开市场出让了3幅宅地,分别是2019年出让的中海长宁第(2020年开盘认购率超400%),2022年出让的上海城投青溪名邸(2024年洋房开盘认购率180%,别墅未开),2023年出让的新长宁西郊云庐(也就是动物园项目,未开盘)。

2024年后,整个长宁区域仅有三盘累计百余套房源入市:夏都·幸福268、青溪雲邸、金色贝拉维。而土地市场端,2024年仅在第八批次土拍中出让了一幅地块,由招商&越秀联合竞得。

去年12月30日,长宁区仙霞社区地块(长宁区W040602单元F1-09地块)出让成交,溢价率约24.53%,楼板价88495元/㎡,未来售价可能达13-14w每平。

那么2025年,长宁都有哪些新房有望入市呢?

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

2023年10月,新长宁以总价27.11亿元摇号竞得长宁区程家桥街道248街坊8丘41-17地块,成交楼板价75350元/㎡,联动价11.8万/㎡。

项目位于中外环间,距离地铁10号线动物园站出入口约1公里,地处虹桥路历史风貌区,紧邻上海动物园、市文物保护建筑沙逊别墅,周边以住宅区域为主。

备注:1.41-17地块内配置900平方米的社区公共服务设施,含便民商业功能服务周边社区,另可考虑其他功能的社区服务设施。

2.41-19地块内应保留连接41-17地块与虹桥路的现状公共通道,通道宽度不小于7米。上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

项目装修标准不低于4000元/㎡,还需要绿色二星级+近零能耗建筑,完成8%公租房比例。11.8万/㎡的单价,千万级的入主门槛,就能和西郊大佬做邻居!

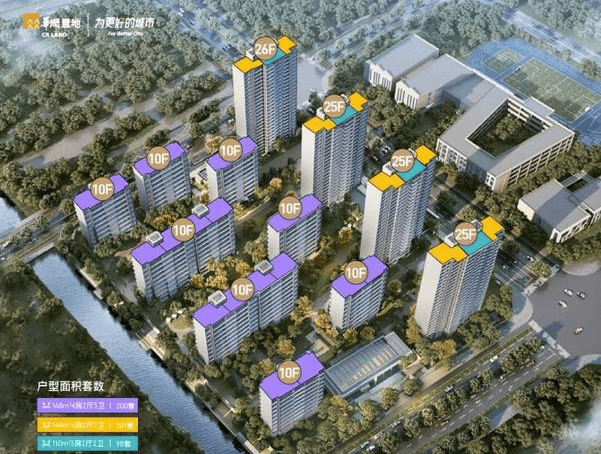

这块地容积率2.0,限高40米,拟建7栋11-13层小高层,共规划305户。

41-17这块地位于长宁外环内,靠近虹桥国际枢纽,紧邻上海动物园,直线距离1号线上海动物园站约900米。原先为龙柏饭店,始建于1985年,周边为龙柏花苑和别墅区,变更规划后清出了一块住宅用地,非常迷你,但对于始终处于供应“底层”的长宁来说,也是弥足珍贵了。该项目主推11-13层小高层住宅,规划292户

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

目前,长宁区待上市的公寓全新盘,同时还“受制于”房地联动价的仅剩1个:新长宁集团程家桥项目「西郊云庐」主力建面约101-105-146-169m²2-3房,少量184-220m²4房,联动价11.8万/㎡,装标4000元/m²,入门仅约1000万+;

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

最新户型图如下:

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

项目位于上海外环内,紧贴着外环高架,往南有延安高架,旁边就是虹桥国际机场。从实探来看,周边被高架立交包围,处于高架旁,噪音问题不可避免。

交通方面:项目直线距地铁10号线上海动物园站约900米,可快速直达虹桥枢纽;延安高架、外环高速双线通达全城。

上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

商业配套方面,周边3公里有西郊百联、福缘湾等商业

教育方面:周边国际学校及优质公立教育资源密集(新房不承诺学区,最终以教育局公示为准)

医疗资源,周边3公里内包括上海申德医院、上海交通大学医学院附属同仁医院等多个大型医院。

生态方面:上海动物园、外环生态绿道环绕,推窗见绿,步行可达。

西郊云庐售楼处电话:400-891-9910上海西郊云庐售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)看房请提前致电预约,可享受内部渠道优惠!联系销售人员获取最新一房一价表,官方售楼处最新优惠底价!开发商官方销售人员将详细介绍每个户型的独特设计和优势,带您参观样板间,感受精装修的品质和温馨氛围。您还可以了解周边配套设施,包括高端购物中心、优质学校和便捷交通网络,让您的居住体验更加完美。

The difference in risk and return between stocks and bonds is mainly reflected in the following aspects:

Risk: Stocks typically carry higher risk than bonds. The stock price fluctuates greatly and is influenced by various factors such as the company's operating conditions and market sentiment, which may result in significant losses for investors. In contrast, bonds have clear agreements and guarantees for interest rates and principal recovery, resulting in relatively lower risks.

Yield: Stocks typically have a higher potential for returns than bonds. Although stock prices fluctuate greatly, it also means that higher returns may be obtained. The returns on bonds are relatively stable and limited, mainly coming from fixed interest income and principal recovery at maturity.

Stability: The bond has a predetermined interest rate before purchase, and investors can receive fixed interest at maturity, which provides a stable expected return for bond investors. The dividend yield of stocks is uncertain, and their dividend income fluctuates with the company's profitability.

The difference in risk and return between stocks and bonds is mainly reflected in the following aspects:

Risk difference: Stocks are often considered a high-risk investment tool because their price fluctuations can be significant, which can increase investors' risk. In addition, if the company performs poorly, investors may suffer losses. In contrast, bonds are generally regarded as a low-risk investment tool. The price fluctuations of bonds are usually smaller than those of stocks, so their risk is relatively low.

Yield difference: Stocks generally have much higher returns than bonds. This is because the returns of stocks not only come from dividends, but also from capital gains brought about by the rise in stock prices. The returns on bonds are mainly fixed interest income, which is relatively stable but lower compared to stocks.

Stability difference: Bonds have a predetermined interest rate before purchase, and investors can receive fixed interest at

热门跟贴